Bitcoin halving events are pivotal moments in the cryptocurrency world, significantly affecting the market dynamics and investor sentiment. These events, which occur approximately every four years, have profound implications for the supply and price of Bitcoin, often triggering both excitement and speculation among crypto enthusiasts and investors.

Understanding Bitcoin Halving

Bitcoin halving is a process built into the Bitcoin protocol where the reward for mining new blocks is halved. This event reduces the rate at which new bitcoins are created, effectively lowering the supply of new coins. The most recent halving occurred in May 2020, reducing the block reward from 12.5 bitcoins to 6.25 bitcoins. The next halving is anticipated to occur in 2024, further cutting the reward to 3.125 bitcoins.

Historical Impact of Halving Events

Historically, Bitcoin halving events have been associated with significant price increases. The reduction in supply coupled with steady or increasing demand has led to upward price pressure. For instance, following the 2012 halving, Bitcoin’s price surged from around $12 to over $1,000 within a year. Similarly, after the 2016 halving, the price climbed from approximately $650 to nearly $20,000 by the end of 2017.

Supply and Demand Dynamics

The fundamental economic principle of supply and demand is at the heart of Bitcoin halving’s impact. By reducing the number of new bitcoins entering circulation, halvings create a scarcity effect. If demand remains constant or increases while supply diminishes, the price is likely to rise. This scarcity factor is a key reason why many investors and analysts view halving events as bullish indicators for Bitcoin’s future price.

Market Speculation and Investor Sentiment

Bitcoin halving events often lead to heightened market speculation and increased investor interest. As the halving date approaches, discussions and predictions about potential price movements intensify. This speculative fervor can drive significant market activity, attracting both seasoned investors and newcomers looking to capitalize on potential price gains.

Long-Term Implications

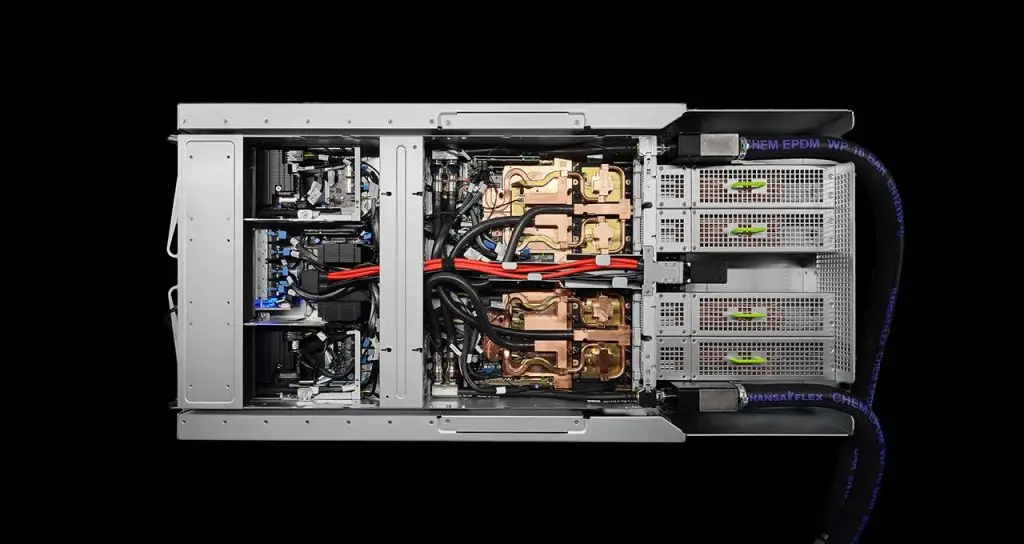

Beyond short-term price movements, Bitcoin halving has long-term implications for the cryptocurrency’s ecosystem. The reduction in block rewards means that miners receive fewer bitcoins for their efforts. This can impact the economics of mining, particularly for smaller operations with higher operational costs. Over time, this could lead to increased consolidation in the mining industry, with larger, more efficient miners dominating the landscape.

The Role of Institutional Investors

In recent years, the involvement of institutional investors in the Bitcoin market has grown significantly. As the next halving approaches, the actions and sentiments of these large players will play a crucial role in shaping market dynamics. Institutional investors often have longer investment horizons and may view Bitcoin halving as an opportunity to accumulate more assets in anticipation of future price appreciation.

Preparing for the Next Halving

As the crypto community gears up for the next Bitcoin halving, it is essential for investors to stay informed and prepared. Understanding the historical context and potential market impacts can help in making informed decisions. While past performance is not indicative of future results, the consistent pattern of price increases following halving events suggests that the upcoming halving could present significant opportunities.

Conclusion

Bitcoin halving is a fundamental aspect of the cryptocurrency’s design, influencing its supply dynamics and market behavior. By reducing the rate of new coin creation, halving events create scarcity, which can drive price appreciation if demand remains strong. As the next halving approaches, staying informed and considering both historical trends and current market conditions will be crucial for investors looking to navigate this pivotal event.